Why I'm Joining High Alpha Innovation🛫💡

Happy Monday! 👋

I’m excited to announce that I have accepted an offer to join the High Alpha Innovation (HAI) Team. When I first stepped away at Upper Hand, I wasn’t exactly sure what was next for me, but I was fairly confident that I wanted to pivot from founder to funder. However, I still loved building companies and the idea of leaving that behind entirely to focus solely on funding left a void within me. As I explored different opportunities, I realized there could be a world where I was able to thrive doing both.

On a basic level, I knew that the next opportunity I took on needed to check three boxes:

Incredible Culture

Great people that are way smarter than me

Get closer to venture

Not only did HAI boldly check all of these boxes, but their unique studio model empowered me to stay close to founders, while also getting immersed in the funding side of the equation.

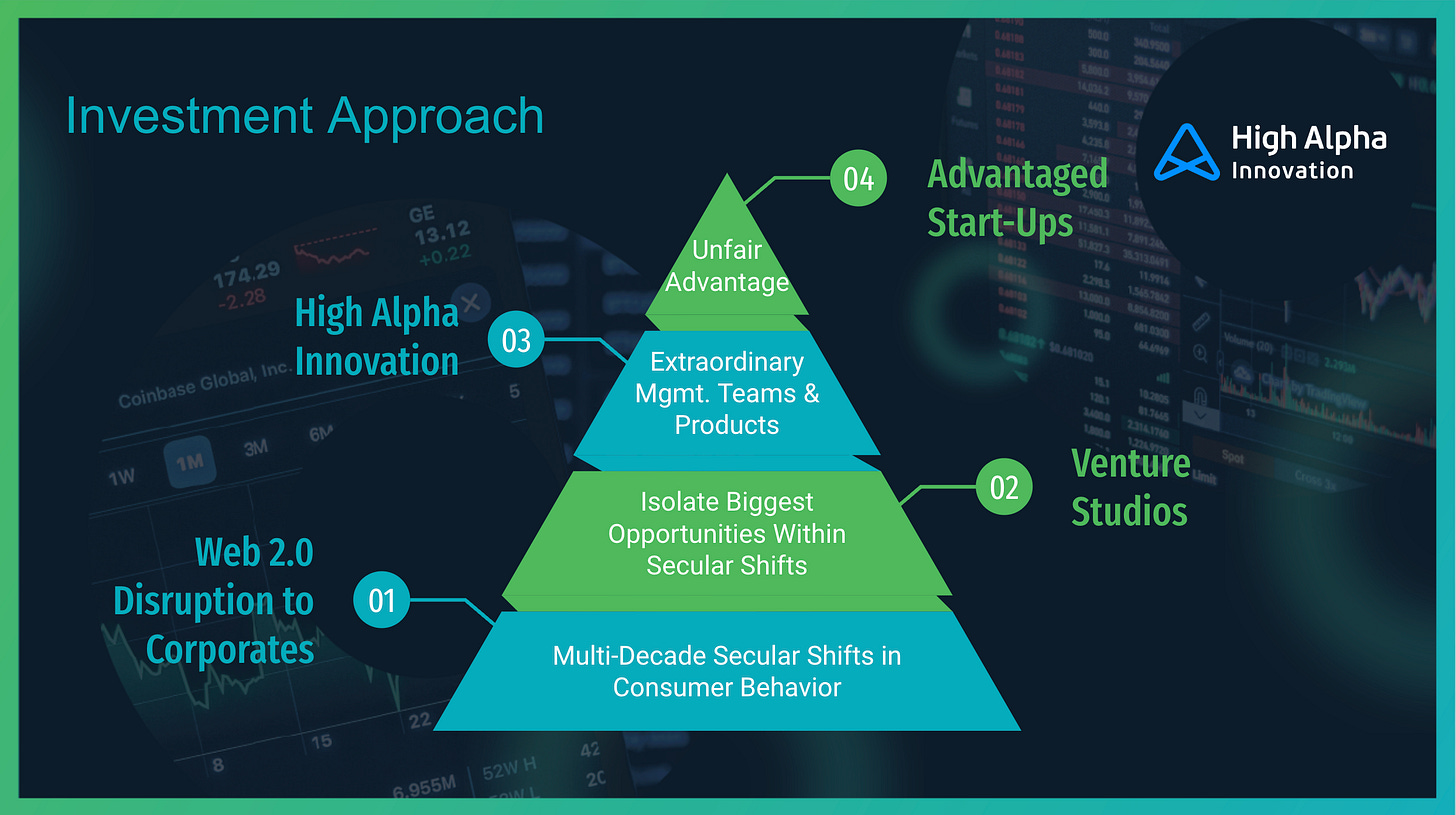

As I reviewed opportunities of what could be next aside from Omnidollar, I made a very intentional decision. In order for me to commit my time to it, our most finite asset on this planet, the business must fit the Omnidollar Investment Pyramid. In this piece, we’ll do a deep dive into HAI, how it fits the Omnidollar mold, and why I’m beyond excited to be joining this world-class team.

Enjoy!

Myles

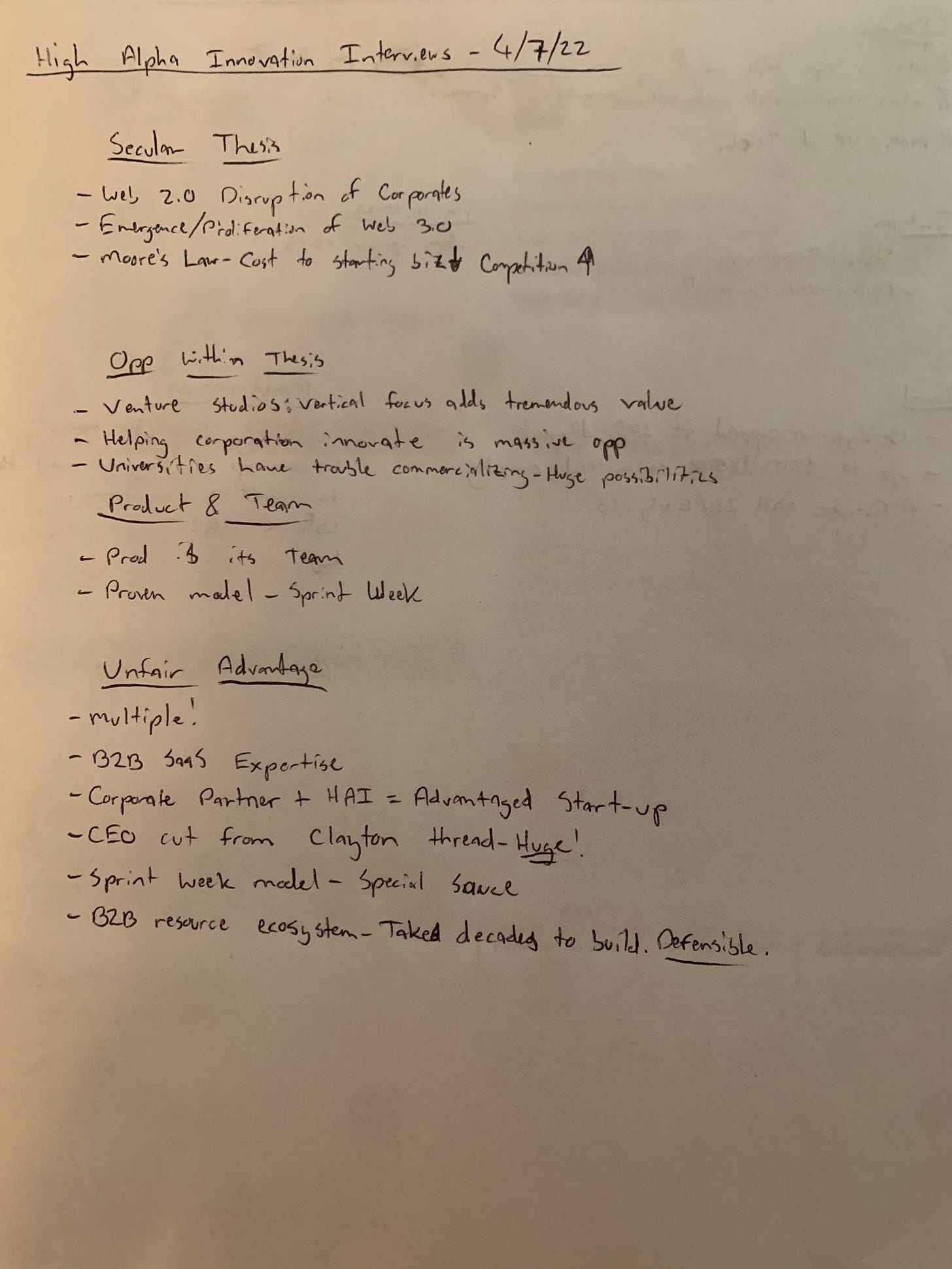

Secular Growth Thesis

If you’ve read any of my previous deep dives, you know that everything that I invest in has to have a significant secular shift behind it at a foundational level. When assessing a potential investment, I’ll first analyze the opportunity to ensure that it fits the Omnidollar Investment Pyramid. Below is a basic version of what it looked like for HAI:

While there are several multi-decade secular shifts occurring simultaneously fueling the adoption of HAI’s product, I’m going to hone in on the top disruptive force: Web 2.0.

Web 2.0 Corporate Disruption

Over the past 20 years, we’ve seen massive disruption to traditional corporate business models. This secular shift really kicked off with the creation of the internet, which eventually led to Web 2.0 in the early 2000s. With Web 2.0, several B2B SaaS companies have emerged to not only make life more efficient for businesses, but they eventually led to the creation of IaaS (Infrastructure as a Service - think AWS). The efficiencies born from the proliferation of SaaS and IaaS products have been huge because they solve big problems, making businesses more efficient. This frees up significant time to do other things like…innovate! Unless, corporate incumbents move too slow or fail to adapt to new times via technological efficiencies while their smaller competitors do.

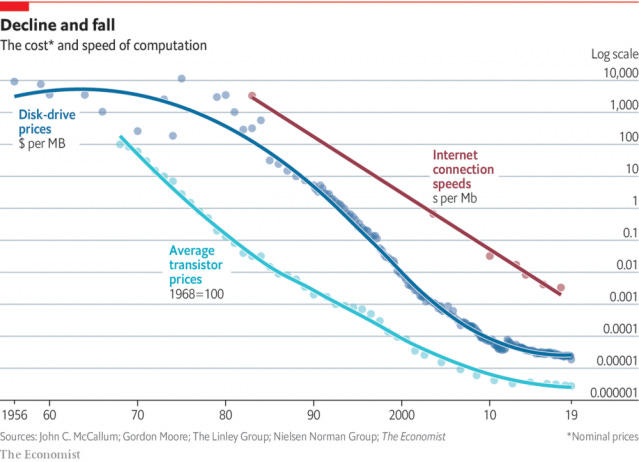

Insert Moore’s Law driving down the cost of computing over time, and you have several multi-decade driving forces fueling incredibly fast rates of innovation.

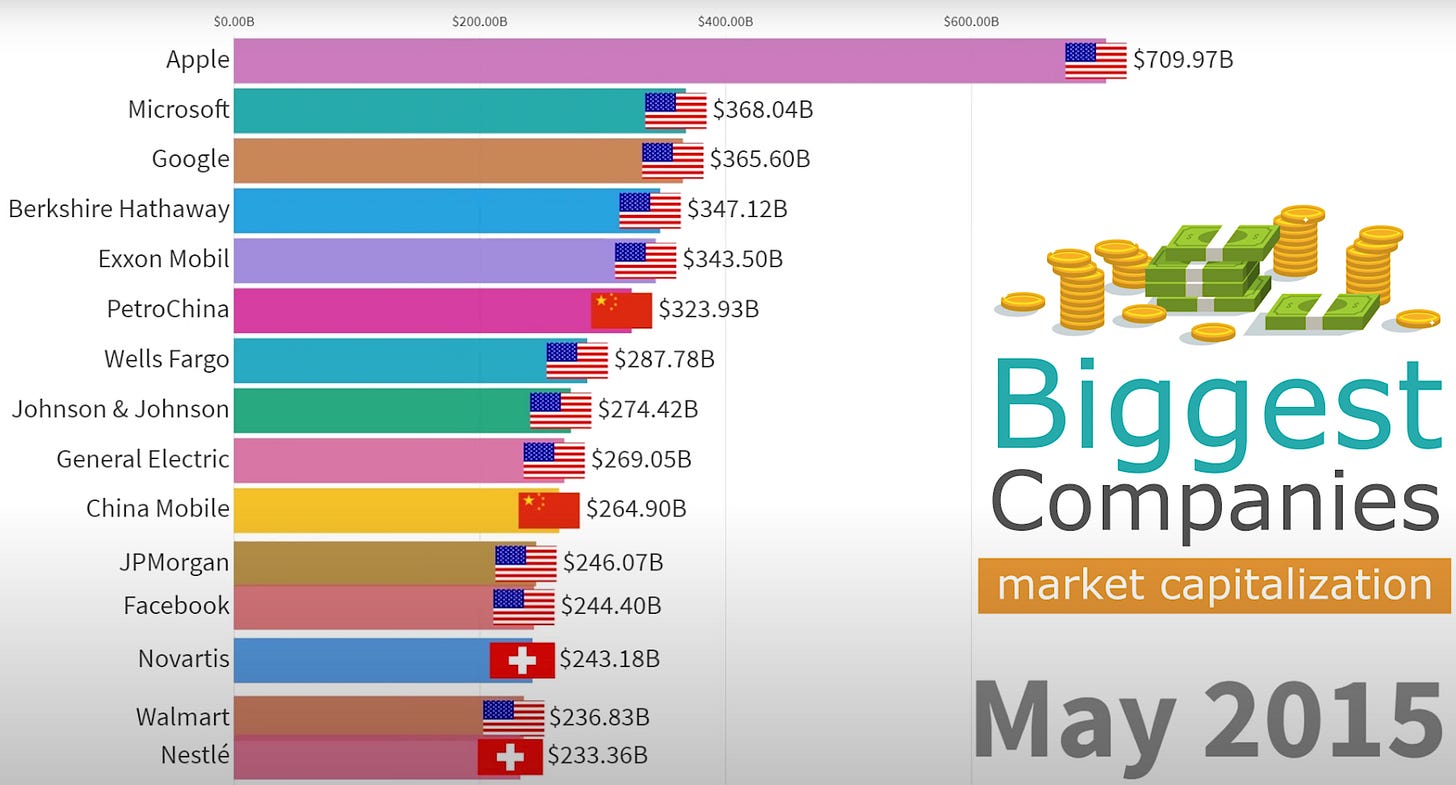

If you haven’t watched this video that constantly reorganizes the top 15 companies in the World ranked by market capitalization over time, it’s worth a few minutes. It demonstrates that it took about 10 years from the inception of Web 2.0 for the top 3 companies in the World to transition from financial/oil & gas/retail companies to tech. In May 2015, the top 3 companies in the World were Apple, Microsoft and Google:

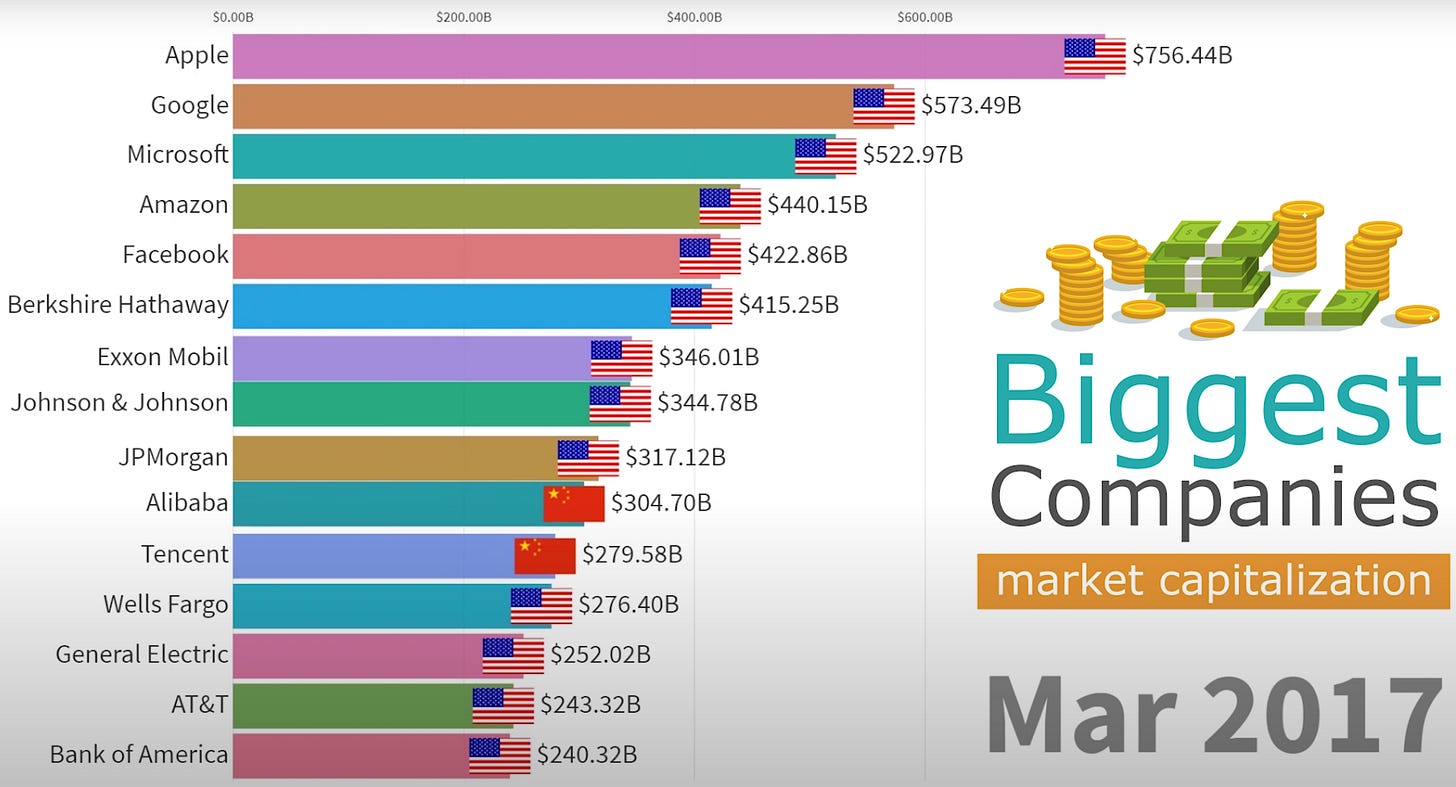

Less than 2 years later in March 2017, the top 5 companies were tech and nearly 50% of the top 15 companies were also tech:

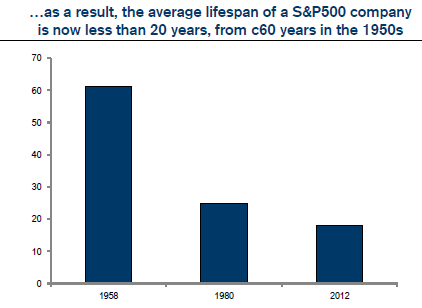

This is important because these companies were built on their ability to drive continuous innovation within their organizations. Apple, Alphabet, Microsoft, Facebook, and eventually Amazon have continued to produce blockbuster (pun) products fueled by their ability to move fast and solve big problems. Take a stroll down memory lane with these companies and you’ll cross a graveyard of incumbents comparable to Arlington National. As a result of the rapid rate of innovation, it comes as no surprise to see a chart like the one below:

Ultimately, Web 2.0 has created 3 key dynamics that have led to a tremendous disruptive opportunity to solve for corporates, one that HAI is well positioned to capitalize on:

Start-Up Technology: Due to the rapid rate of technological innovation, start-ups are being built around extremely scalable & cost effective platforms. Consider the cost for an incumbent to migrate millions of customers to a cutting edge software platform that will allow their engineering team to innovate faster. Now consider the new start-up competitor that uses this same technology in their MVP, allowing them to go 10x the speed of the incumbent. With rapid rates of innovation, you can see where this quickly becomes problematic for larger companies that aren’t able to move as fast.

Adoption of SaaS Products: In order to drive efficiencies within their organizations, larger corporate adoption of SaaS products has never been more important. This is fueling demand as new problems continue to emerge from continuous innovation.

Higher Cash Flow Fuels Growth: Because SaaS businesses generally boast ~80% gross margins and collect on sales contracts up front, they are able to generate more free cash flow and reinvest more into innovation. Couple this with significant capital tailwinds in a low rate environment, and you have new entrants that have been able to prioritize growth over profitability, leading to further innovative disruption as they continue to reinvest free cash flow into effective innovation strategies.

The Opportunity

Before we dive in, let’s do some housekeeping on High Alpha’s structure. It’s broken into three distinct units:

High Alpha Studio: This is the original model that has propelled High Alpha to a world-renowned venture studio. Via the infamous “Sprint Week”, very intentional problems are taken through a rigorous innovation process, ultimately landing on a viable business “plan” (pitch deck). From there, High Alpha recruits world-class founders to run the companies, while also seeding them with capital. The most recent public information that I could find indicated that they launch around 4 companies per year.

High Alpha Capital: An early stage B2B SaaS venture capital arm that differentiates via proprietary deal flow from High Alpha Studio. They’ve built an impressive portfolio which at the time of this writing consisted of 10 exits.

High Alpha Innovation: Leveraging the venture studio model & sprint week pioneered by High Alpha, HAI partners with corporates & universities to help them innovate. Together, we create advantaged start-ups that have a far greater chance of success than even traditional studio models are able to produce.

With a basic understanding of the different units, the collective portfolio of High Alpha solves a massive problem:

Even today, starting and running a successful SaaS business is incredibly difficult.

Furthermore, the unit that I am joining, High Alpha Innovation, is focused on solving an even bigger problem:

Continuous corporate innovation is incredibly difficult and more important than ever before. With the rapid rate of technological innovation, corporates are quickly falling behind and struggling to stay relevant. While companies have gone to incredible lengths to foster continuous innovation, most fall flat. In a memorable piece of an unmemorable book, I read that the most important things happening at your business are actually outside your walls. One of the many beauties of innovation is that the applicability of new technologies or systems are endless. Perhaps the model for continuous innovation has been around for a while, but most corporations were simply looking for it in the wrong place. Maybe the venture studio model is what they’ve been looking for all along.

Venture Studios & High Alpha

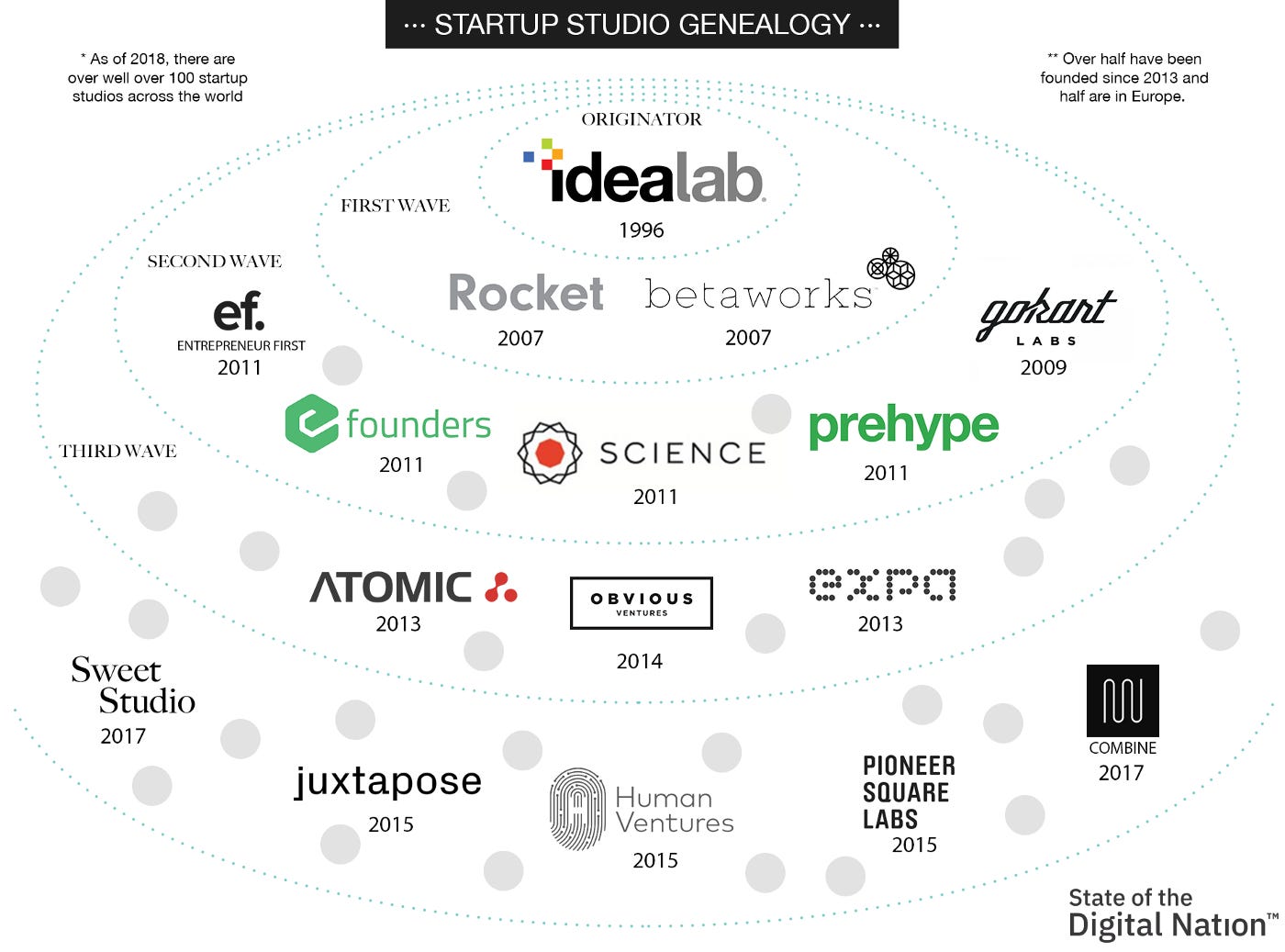

The venture studio model is nothing new. It’s actually been around since 1996, before the internet really took off. As time has eclipsed, more and more venture studios have continued to emerge. This is always a great sign in respect to the success of the business model.

Below is an image to show the evolution and growth of the venture studio ecosystem. While High Alpha is not listed (sham!), they are currently rank as a top 5 leader out of over 700 studios world-wide:

Additionally, here’s a Twitter list of the major venture studio participants. At the time of this writing, it’s flooded with High Alpha posts and I don’t think there is any coincidence about that. Google “definition of venture studio” and it’s also no surprise that High Alpha is the top result:

While they didn’t invent the model, they’ve flown it to a new stratosphere.

Since Kristian Andersen, Mike Fitzgerald, Scott Dorsey and Eric Tobias launched the first High Alpha Studio in 2015, I’ve been enamored by the machine they’ve built. From the unique aeronautical themed office that serves as subliminal elements of a fast-paced, high flying culture, to the undeniable track record of success, it’s hard not to want to be a part of the journey.

You can feel the culture from a mile away.

Enter the doors from the trendy Bottleworks District in Indianapolis, and you’re transported into a launchpad. The first time you walk in, a uniquely disorienting feeling sweeps over you. Enveloped by darkness, you’re guided by a slim, dim trail of light overhead as you find your way to the elevators that take you to where the magic happens.

In a way, entering the High Alpha studio parallels my journey as an entrepreneur. When you first make the leap, it’s dark and disorienting. Every day, the dim light guides you a little further…a little closer to “take off”. As you continue to test, fail and iterate, you eventually find the way up. And once you take off, there’s no turning back. On the way up, it’s turbulent, but eventually you find smooth air.

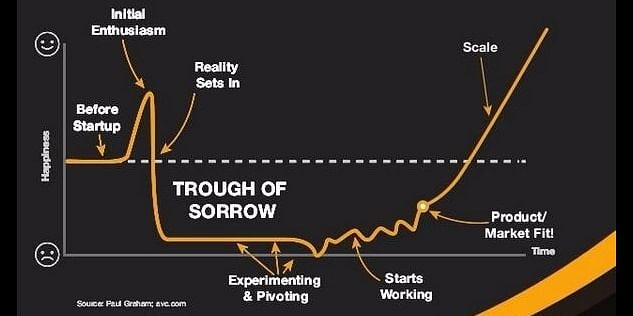

The studio model makes that dim light brighter, making the path to success much easier to find. It gives you a little more confidence in finding that stable air. As a first-time founder disrupting an antiquated space, you undoubtedly will have competition. Thus, time is of the essence. You are forced to build and execute as quickly as possible, which includes breaking things and failing. The recipe for success is that you break small things quickly, take your key learnings, and rapidly apply them to continuing to build. If you go too fast, you risk breaking something too big, which can ultimately result in your company’s demise. If you go too slow, you don’t learn quick enough which leads to you being outpaced by your competition. You typically do this in the early days while toeing the line with insolvency. It’s an incredibly stressful, difficult and dogged environment to operate in.

This environment is likely a big reason that 90% of start-ups fail.

The studio model, enriched with incredible amounts of experience, talent and resources, rapidly transforms the small failures into opportunities, and significantly reduces the risk of the founding team breaking anything too big.

While High Alpha Studio has solved a big problem in the B2B SaaS segment, ultimately creating a new de-risked returns distribution model, High Alpha Innovation is leveraging the studio model to solve an even bigger problem.

The Innovator’s Dilemma

If you haven’t read the book, The Innovator’s Dilemma by Clayton Christensen, I highly recommend it. It explains the power of disruption and why market leaders are often set up to fail. This book was published in 1997, right before the mass adoption of the internet kicked off. Very timely given what was to come over the next several decades in the form of technological disruption to antiquated, complacent industries.

At some point in time, a well-established business likely followed one of these paths:

The Better Mousetrap: The business entered an already-established industry, did something different and better than their competition, took market share and grew to a point where they were self-sustaining.

The Disruptor: Innovative founders leverage a new technology or re-purpose an existing technology to create an entirely new way of solving a big problem. The business experiences hyper adoption, and as a result, quickly wreak havoc on industry incumbents (disruption). Eventually, they land in the same spot where they reach a point on the S curve where the business begins to flatten and the market is saturated.

At the point of self-sustaining, or in other words a position of comfort, it’s human nature to relax. This is the corporate…

When incumbents become complacent, the wedge between innovation and antiquation grows larger and larger by the day. The end result is the ultimate disruption: Bankruptcy as a result of obsolescence.

Enter…

HAI externalizes the studio model to enable corporations to innovate at speed to compete. Uninterrupted and completely removed from the potential red tape that impedes innovation, beauty happens. Within a week’s time, ground-breaking new solutions to their biggest problems emerge in the form of a new business with the potential to recruit world-class founders that are ready to build and scale.

An Advantaged Start-Up is Born.

The Team

It’s no coincidence that our CEO, Elliott Parker, spent 6 years at Innosight, the consultancy founded by Clayton Christensen.

From top down, the team is top notch. As I’ve continued to meet more people from HAI, I’ve realized that this team is very special. From ballet dancer to corporate development, to Wharton School MBAs, the team is ripe with interesting backgrounds and experiences that contribute to a diverse and high functioning team. It has become abundantly clear that I am about to be surrounded by great people that are way smarter than me✅.

I felt the incredible culture✅from the very beginning, one that has been built on core values that I quickly resonated with and saw myself fighting for through difficult times:

You’ll notice the checkboxes above, as these were two critical components that I was looking for in order to join a team. In my experience building in the past, core values are the foundation that you build a team on. Without them, your business lacks a key ingredient to success. Without an amazing team, you can have the best product in the World and still ultimately fail. Fortunately, equally amazing is the product that HAI has developed.

The Product

I’ve now mentioned Advantaged Start-Up multiple times throughout this deep dive, and it’s with good reason. The creation of an advantaged start-up is ultimately HAI’s flagship product. Given there is no formal definition of what an advantaged start-up is, I’ll do my best to wordsmith:

“An early stage business built from a unique pool of entities & resources that collectively form a significant unfair advantage.”

There’s no coincidence that I would pick a company that is uniquely positioned to create start-ups with significant unfair advantages (more on that later). The more important question is how is this product built and how exactly are the companies advantaged?

Sprint Week

When I started Upper Hand (bookacoach at the time), I worked with my business partner, Kevin, to create a 100+ page business plan. I did this not because I thought it was the best way, but it was the only way I knew how to do it at the time. Based on my business school education, it’s what I was taught that investors expected. All in, we spent nearly a year building a business plan/ trying to raise capital. This turned out to be mainly a waste of time.

Our story is not uncommon. The infamous image below has historically taken start-ups years to accomplish:

Sprint Week’s unique and proprietary elements compresses years in to about 4 days, resulting in 4 common challenges being solved or significantly de-risked in record time:

Build: Through a unique amalgamation of subject matter experts, corporate partners and HAI’s internal team, the foundation for an MVP is developed. Having built a handful of MVPs in the past, one of the most time consuming pieces is obtaining industry expertise and validation of your assumptions. Customer discovery, while a lot of fun for me, is extremely challenging. To complete this in such a short period of time is sublime.

Recruit: Once the MVP is established, the HAI Talent Team recruits world-class founders that have a unique combination of deep domain expertise and operating experience. To put it bluntly, their team goes out and lands unicorns on a monthly basis to run these companies. No easy feat.

Scale: Through HAI’s corporate partners, they provide invaluable opportunities for their founders to lock down beta customers and/or channel partners who provide invaluable product feedback. Leveraging these key relationships, founders are able to find product market fit much quicker than they would be able to “out in the wild”.

Fund: Ask any founder how they feel about fundraising and you’ll get the same answer 99% of the time: “I hate it”. Leveraging both the corporate partners and/or their extensive rolodex of capital partners results in one of the most difficult aspects of scaling a business being vastly blunted. Additionally, because of the incredible coalescence of resources that HAI brings together, every entity involved enjoys richer valuations, especially in the earlier stages of the company. This leads to less dilution for stakeholders over the life of the business.

As I continued to dissect the distinct elements of the business, the problems solved by Sprint Week quickly became the cornerstone, the undeniable core pillar, of why I wanted to join this team. As a previous founder, this is the “rainbows & unicorns” scenario that you dream of when starting your first company. It’s a big reason why the HAI Team is literally creating a new corporate asset class before our eyes.

A New Corporate Asset Class

Outside of the primary means to innovate (R&D), corporates traditionally lean on corporate development to fill the gaps:

M&A: Merging with or acquiring a company that compliments an existing product offering, or provides path to a new market.

Joint Venture: Strategically partnering with another company to achieve something that would be difficult or impossible to do without joining forces. Most recently, I’ve noticed technologically antiquated companies attempt to take minority stakes to play catch up and fill tech voids.

When executed well, these methods of innovation can be fruitful. However, they each have significant inherent risks.

HAI extrapolates their systematic way of creating new businesses (Sprint Week), and molds it in a risk-adjusted way. This allows corporates to innovate in a manner that was never possible before. This novel concept empowers corporates to create an entirely new asset class to better compete with fast moving competition. This new asset class enables corporations to rapidly learn in far-adjacencies, create strategic partnerships that amass direct value, and activates an entirely new standard of optionality.

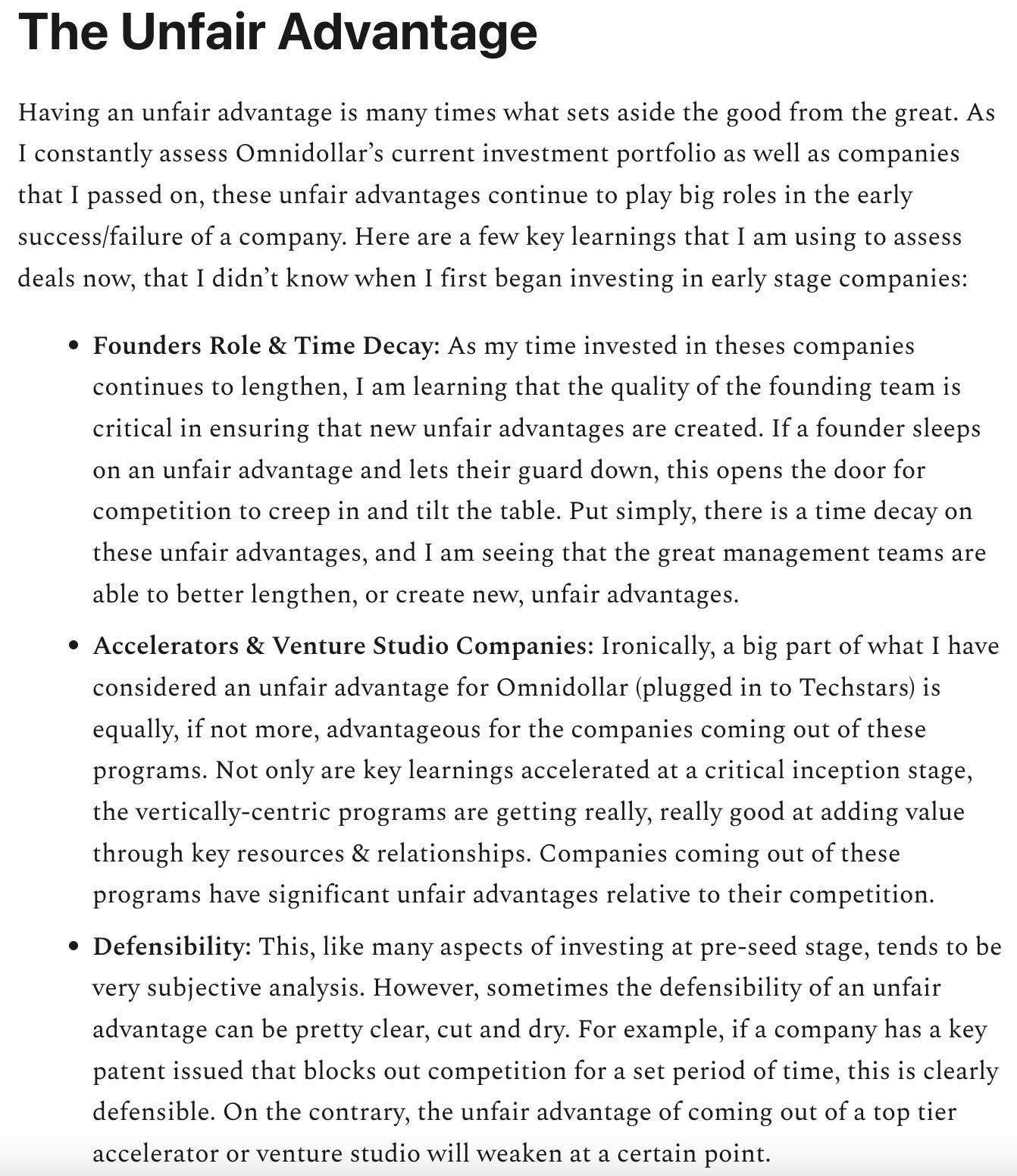

The Unfair Advantage

With the ease & low cost of standing up a business today vs 20 years ago, the importance of unfair advantages has never been greater. For fun, I am going to release a teaser from an upcoming investment deep dive that I am waiting to release. The relevance as it relates to corporate innovation and my joining HAI is very strong, so I just couldn’t resist:

As you can see, I’ve learned a lot about unfair advantages as it relates to my investments. In the case of HAI and the market it serves, the competition has continued to grow over time, so it was very important for me to understand and believe in both management and existing unfair advantages. Below are the ones that I drew out as I was in the thick of the interview process:

B2B SaaS Crazy Quilt: I read recently about the “Crazy Quilt Theory” which goes like this: Get as many great people with a vested interest involved in your business which leads to these people doing whatever they can to help you succeed. This creates significant business tailwinds. The Crazy Quilt that has been built at High Alpha over the past 20+ years of B2B SaaS experience is near impossible to replicate.

Sprint Week: Aside from the extraordinary team, this really is the special sauce that makes HAI unique. While in theory, companies can replicate this, 7 years of practice and refinement is not easily replicable. With this being such an integral part of the culture and has been for so long, this is a clear unfair advantage.

CEO Corporate Innovation Knowledge: You want to talk about “product market fit”, Elliott Parker is cut from the cloth of Clayton Christensen, the most relevant thought leader in the World as it relates to corporate innovation. If this isn’t an unfair advantage, I don’t know what is. The bank of knowledge and credibility that he brings to the team is incredible.

It’s hard enough to have 1, but to have 3 bonafide unfair advantages in such a competitive field is just…not fair! Ultimately, the combination of these unfair advantages leads to a potent cocktail: The unique and unfair ability to create advantaged start-ups.

It’s no wonder that the economics of the business are so incredible for all parties involved.

The Business

Given that there are over 700 studios world-wide now, you’ve probably been able to surmise that the overall business opportunity is healthy. And while that is very true for the standard studio model, it’s especially true for the application of the studio model to corporate innovation.

Economics

While I can’t go into as great of detail as my typical deep dive, I can tell you the primary reason why I was bullish on the economics of the business. As I went through the interview process and learned more about the team & the role, I quickly realized that this team understood how to structure deals in such a way that everyone won. By sheer human nature, let alone the brutal truth that capital markets tend to deliver (zero sum game), this is a very difficult thing to do.

By being true and honest partners to their customers and the founding teams, they are uniquely positioned to build advantaged start-ups. Their incentives are properly aligned with the equity that is created, and the end result is a long-lasting path to creating significant value for all parties.

Traction:

HAI has super ambitious plans to launch 100 companies in 5 years, which boils down to about 2 companies per month. At the time of this writing, 5 companies have launched out of the studio, with another 9 in the queue before the end of the calendar year.

I have to take a step back and consider how incredible this will be once achieved. The fact that a single entity can launch 100 companies in a 5 year period blows my mind. But then I consider the TAM and how massive it is, and I realize that 100 companies doesn’t even scratch the surface of possibilities.

Summary

When I first met with Scott Dorsey in the Fall of 2021 to get some general professional advice, I honestly did not know what was to come next. I had devoted blood, sweat and tears to helping Kevin and the team build Upper Hand for a solid decade, and frankly I was beyond exhausted. It was very difficult to see clearly from where I stood at that time. It was in that meeting when he asked me if I had given any thought to what was next that I first realized that I could see myself at High Alpha. It was the first time that I had stepped into the building, and while I entered the doors a bit disoriented, I left seeing a little more clear. It took almost a full year to earn the opportunity, but here we are.

“I had thought the destination was what was important, but it turned out it was the journey.” -Clayton Christenson

It took me the experience of building Upper Hand to understand that there is no clear destination. No clear finish line when building a business. When I look back over the past 10 years, I see it as a part of the larger journey of life that has brought me to this point. What lies ahead, I have not a clue. But, I know that the journey has prepared me for what’s to come next. And I couldn’t be more excited than I am today. Onward!