Project Admission: The Stripe of Ticketing🎟

Project Admission Raises $5.5M Seed Round to Disrupt the Antiquated Ticketing Industry.

Happy Monday! 👋

I’m excited to announce that Omnidollar portfolio company, Project Admission, has closed their Seed financing round of $5.5M, led by London-based Anthemis Capital, with participation from Flyover Capital and yours truly, Omnidollar.

The team at Project Admission has fought hard to get to this point. It’s incredibly difficult to successfully raise a seed round, let alone to do it coming out of a Global Pandemic that forced your industry to shut down completely for over a year.

From the first time that I met the Project Admission Team, I was super excited about their potential. I’ve always hated the ticketing experience, and have felt that it needed some good actors to come in and give it a solid makeover. I think the time is now, and I think the Project Admission Team is going to be the one to do it.

Enjoy!

Myles

Secular Growth Thesis

Given that this is our first public investment memo, I want to shed some light on our investment approach before I go into detail on why we invested in Project Admission.

At Omnidollar, we are long term secular growth investors. We seek to support and invest in innovative disruptors that are creating unstoppable secular shifts in consumer behavior. These unstoppable secular shifts in consumer behavior are the foundation of our investments, and without them, we simply will not invest. When evaluating investment opportunities, we try to deeply understand 4 primary layers.

Omnidollar Investment Approach Pyramid:

Secular Shift: It’s very difficult to find category creators that eventually become category definers. These are extremely rare opportunities that many times are riding the wave of a new technology that now enables them to change the way consumers operate in a specific function or vertical. These secular shifts create unstoppable tailwinds for businesses, making it much easier to scale, sometimes without even having product market fit.

Opportunity within Secular Shift: Once we have determined that there is either a secular shift already occurring, or we see one coming downfield, we try to isolate the biggest opportunities within the secular growth thesis.

Quality of Management Team & Product: Having operated in the past, we know firsthand that team is everything. Without a special team that complements each other well, there will never be an amazing product. However, in a hyper competitive environment, the most proficient product will always win. Even when there is little to no competition within a market, if we are picking the right secular growth theses to invest in, then the competition will come. It’s critical to us that the team & product are top notch as a result.

Unfair Advantage: Building a company from the ground up is incredibly difficult no matter what. However, the path is much easier when you have an unfair advantage. While it’s not critical out of the gates, we want to invest in companies that have a clear path to developing an unfair advantage.

In assessing whether or not to invest in Project Admission, we followed this approach and the pyramid looked like the following:

Starting with the foundational layer of the pyramid, we’ve seen over the past decade a keen desire from the consumer for technological decentralization. The best example of this would be blockchain technology and the rise of Bitcoin (DeFi), but we’ve seen it in the payments industry with Stripe democratizing payments, and Shopify democratizing e-commerce. Most industries and core consumer activities have had technological disruption that has more or less empowered businesses and consumers to have more control of the primary activity. However, there are still industries that are playing from behind for a multitude of reasons, including the ticketing industry.

The ticketing industry as a whole is dominated by a handful of legacy players with very high barriers to entry. This has resulted in antiquated offerings, minimal innovation, and significantly low consumer satisfaction. The combination of these three together present the perfect industry to be disrupted. Contrary to some of the other secular shifts that we invest in, this one has really yet to take hold as it is in the very, very early stages.

The Opportunity

There are many problems in the ticketing industry, but distribution being one of them blew my mind. You’d think that an industry as mature as ticketing would have robust distribution technology that enables inventory to vanish at the blink of an eye. Through our research, we found this to not be the case. Aside from the opportunity being right, timing is critical to capitalizing on any large secular shift. Given that we are now coming out of a once in a 100+ year, industry-changing global pandemic, the stage is set for innovators to disrupt the archaic ticketing industry. Before we hit home the opportunity in ticketing, using one of the above examples of decentralization that has already occurred within an industry, let us un-package “The Stripe of Ticketing” title and draw on a quick parallel: The Payments Industry.

The Stripe of Ticketing

About 12 years ago when Stripe was founded, if you wanted to accept online payments, you had three options:

Paypal: This was the de-facto standard for accepting online payments. The main problem here was that you had to leave the business’ checkout experience and enter the Paypal experience. The business also had zero opportunity to make revenue off of their own payments.

External 3rd Party Site: Similar to the Paypal option, there were other 3rd party vendors that you could leverage to submit payment. However, leaving the “trusted” site that you were on to a 3rd party site felt sketchy and not secure.

Build Your Own: The final option was to build expensive, clunky payment portals on your own website using payment gateways such as Authorize.net. This route was often too cost prohibitive for small businesses to build their own.

All of the above were generally a terrible user experience or simply too costly to implement. In each of these different scenarios, businesses had little to no control of their payment experiences.

Enter…

They disrupted the industry by creating an end to end payments API that essentially allowed a business to become their own Payment Facilitator (PayFac) within their own branded environment. Not only did they empower small businesses to own their payment experience, but they enabled marketplaces such as DoorDash to be able to easily transact. Businesses not only had more control of the payments experience, but they were also able to better monetize their payments. Essentially, Stripe decentralized payments, giving way more power to businesses. Now, we are seeing similar dynamics with the decentralization of fiat currency via cryptocurrencies built on blockchain technologies. The latter is a whole different level of decentralization as there is no platform owned by a singular party such as Stripe.

As I researched the ticketing industry and met with management at Project Admission, I quickly began to see the strong parallels to the payments industry. While fundamentally they are very different, mechanically I see a very similar dynamic playing out within the ticketing industry. This was a big reason that I was so intrigued, because I had seen this story before, to the tune of a $94B valuation (Stripe 3/14/21 valuation).

Decentralizing Ticketing Distribution

Similar to the payments industry 12 years ago, the ticketing industry’s power and responsibility is very centralized. You really have three main layers of ticketing:

Rights Holder: The venue, promoter, event producer or sports team that holds the rights to the event being sold. This could range anywhere from the Indiana Pacers to the producers of Lollapalooza.

Primary Ticket Markets: The ecosystem that the rights holder sells their tickets within. Rights holders will typically have a ticketing partner that they will allot their inventory to in the primary market. Examples include Ticketmaster which the Pacers use as their primary ticket partner.

Secondary Ticket Markets: Low and behold, you have the notorious ticket scalpers and brokers that everyone as a consumer loves so much! Transactions in the secondary market are typically done through marketplaces such as StubHub or Vivid Seats. They allow for the consumer to sell their tickets, typically at a premium, and they many times tack on gaudy fees to use their marketplace technology to transact.

In this industry, primary ticketing partners hold all of the cards, as they hold the inventory. Because they hold all of the inventory, they also have a distribution problem as their platforms (i.e. ticketmaster.com) are generally the sole technology platform to distribute these tickets. For more popular live events, consumers combined with ticket brokers may purchase a lot of inventory due to higher demand. However, even for some of the most popular live events, the ticketing partners end up with unused inventory. On top of excess inventory issues, they have little control outside of their primary distribution platforms.

So how big of a problem does this translate to in terms of dollars? Out of the $242B in global live event ticket sales, $64B of primary tickets go unsold.

Source: Project Admission Pitch Deck

Enter…

Similar to how Stripe decentralized the payments space by empowering small businesses to own their own payments experience, Project Admission’s robust backend infrastructure allows ticket rights holders to decentralize distribution of their inventory.

The Team

Project Admission is the one company that we've seen that has a high likelihood that they’ll be able to disrupt the $1.2T global ticketing industry. When we first met the team via the Techstars Sports Accelerator Powered by Indy, we knew little about the ticketing industry. Again drawing on the payments industry parallel, we found the industry to be very convoluted and frankly, broken. We had to seek within our network to find connections with domain expertise in the ticketing space to learn more about the industry and validate the bigger problems in the arena. Ultimately, we really liked Project Admission for three simple reasons: Team, Product and Strategy.

In addition to them having a solid tech team, all 3 of the co-founders had tremendous experience within ticketing, and as a result, very strong connections within the industry. We felt like this was going to be critical to make headways into bigger players such as Ticketmaster.

The Product

We were initially attracted to the team, but once we learned more about the tech team, specifically Co-Founder Tom Giles, we got even more excited. At a foundational level, the tech that they have created enables rights holders to decentralize ticket distribution. But there is much more to the product than just that, as they have created a powerful product that gives the rights holders the ability to recapture or create tremendous value throughout the entire ticket lifestyle.

The beauty of the tech is that similar to the travel industry where the same airline ticket can be listed on Priceline, Orbitz or Kayak, Project Admission’s tech creates the ability for the ticket inventory to be distributed in multiple places at the same time. Eventually, I see a World where Project Admission’s tech sits in between the rights holders and the primary ticket partners, allowing for the rights holders to distribute their tickets through any platform.

Below is an image to highlight key value add at different points of the lifecycle:

Source: Project Admission Pitch Deck

However, the root problem being solved is still within primary distribution, or the Discovery and Pre-Event phases in the image above. In the example below, you can see how a company, Webull (financial firm), was able to stand up their own store for their employees to purchase discounted tickets to the Brooklyn Nets game. This in and of itself is not new to the industry as there are other competitors, mainly Spinzo, that is integrated with Ticketmaster’s inventory system. Spinzo is a single layer platform focusing on group sales.

As an example of the value that Project Admission adds beyond the discovery and pre-event phases, the ticket lifecycle typically would end as soon as the event is over. But, with Project Admission’s Awesimo product, rights holders can now offer limited commemorative NFT tickets. This opportunity also highlights the beauty of the economics of their platform, which we will un-package more later.

The Unfair Advantage

From our research of the industry, we quickly realized how important a strong network was going to be in order to scale within this market. Because of the moat that exists in the primary market, partnerships with the primary ticketing partners of the rights holders was going to be critical. We typically don’t consider strong networks as a defensible unfair advantage, but in this industry, we considered it the prerequisite and key piece of the puzzle to develop a moat.

Given the strong advisor network, decades of combined ticketing industry experience and an extremely proficient technical team, we felt that this was the right recipe to develop the appropriate technical partnerships with the primary ticket partners. In our eyes, this is the biggest barrier, but also the biggest key to success.

The Business

Project Admission is planting its flag in an industry that boasts extremely healthy margins with incredible unit economics. While their business is still young, the industry’s economics are long established. But the most exciting part about the business is the potential that new technology such as blockchain and NFTs to further drive up the economics of the business. Overall, traction will be gained via strategic & technological partnerships with rights holders and primary ticket providers, respectively.

Economics

So how does Project Admission make money? Their pricing model is simple:

Primary Market: 10% of the Face Value (FV)

Secondary Market: 10-20% of FV

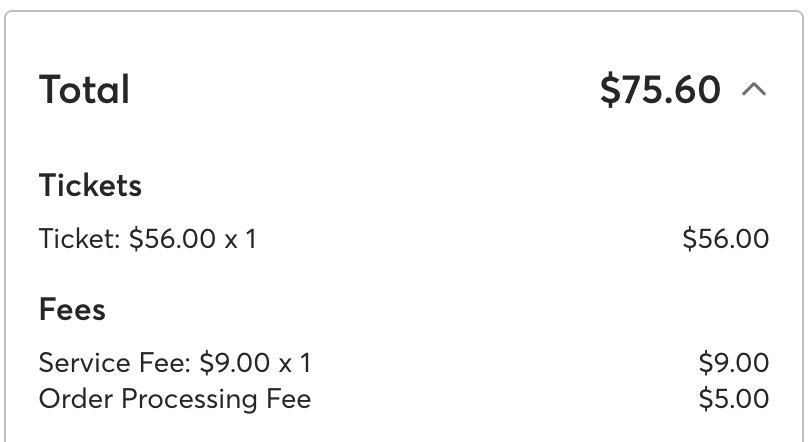

With that said, it’s important to understand the economics of the industry as a whole. Using a real life example, let’s assume I buy a concert ticket to see Phish and a sporting event ticket to see the Pacers. For these two purchases, I am looking at 43% and 25% of face value in fees, respectively.

According to The Guardian, these fees vary from event to event and are negotiated by the rights holder and the primary ticket provider. We were able to confirm this via Ticketmaster’s help page, too: “In both cases, these fees are collected by Ticketmaster and typically shared with our clients.” The way the fees are split up also varies, so it’s impossible to know the exact economics of each transaction. However, the important thing to note is that the Service Fee is split by multiple parties and is flexible from event to event. Furthermore, the service fees will almost certainly increase as you move from the primary market to the secondary market, depending on what type of platform you use to re-sell your tickets.

For example, if I can’t go to the Phish concert all of a sudden and need to sell my ticket, I’ll need to sell the ticket on the secondary market. If I were to go to Ticketmaster’s marketplace and re-sell the ticket, I will pay 15% of what I decide to charge as the seller, and the purchaser is going to pay 10%. If this transaction occurs again, well, that’s another 25% of the value going back to Ticketmaster! For simplicity, let’s assume that the ticket is sold three times at the same face value each time all through Ticketmaster. The fee economics look something like this:

Initial Sale: $20.70 (43% of FV)

Secondary Sale: $12.13 (25% of FV)

Tertiary Sale: $12.13 (25% of FV)

Total Fees LTV: $44.96 (93% of FV)

Now, let’s take it one step further. Imagine a commemorative ticket created by Project Admission’s Awesimo sells initially for $100. They will make profit on this transaction for the life of the asset, which is theoretically infinite. Let’s assume that I can live for another 60 years and that over this timeframe, the commemorative ticket will exchange hands once every 5 years, and will appreciate at 10% annualized. Finally, let’s assume that Project Admission charges a 10% transaction fee each time the NFT trades hands. The economics of this scenario look something like this:

The fee LTV on this NFT equates to about 7,000% of the original face value! As you can see, this industry already has phenomenal economics, but with the introduction of technology such as blockchain and NFTs, the economics have incredible potential.

Traction:

Project Admission has leveraged their deep industry connections and supreme tech to secure partnerships with some of the biggest ticket providers in the World, including SeatGeek, Tickets.com and Logitix.

They have been in long negotiations with companies even larger than their current partners, and we are optimistic that they’ll be able to get some of these over the goal line in 2022. Given the significant impact of Covid on the live events industry, Project Admission is still very early in the growth trajectory. With the World’s largest economies re-opened and live events back, this will soon change given how they allocated their resources throughout the global emergency. By instituting an unwavering focus on securing key partnerships and solving their industry’s core problems in normal life (not in pandemic life), they’re well positioned to begin scaling.

Summary

Project Admission has a bright future. I was excited the first time I met Stephen, Tom and Jordan, but as I’ve dug more and more into the industry, I’m ecstatic that Omnidollar had the opportunity to support these incredibly talented founders. In the end, every company and nearly every consumer interaction with these companies are digital in nature. Due to high barriers to entry, the ticketing industry is one that has developed a sense of technological complacency. Until now.

Project Admission’s deep domain knowledge, incredibly talented leadership team, and keen focus toward building superior technology solving multiple problems throughout the ticketing lifecycle will prove to be The Golden Ticket.

Derogatory article. You are Myles off on this

You’re beyond ignorant and clearly didn’t do real diligence. Your investment is going to zero.