Ergatta: The Next Connected Fitness Unicorn🦄

Since Omnidollar invested, Ergatta has taken connected fitness by storm, raising $35M at a $200M valuation

Happy Friday! 👋

I’ve never been as excited as I am today to write an investment memo. Not only was Ergatta Omnidollar’s first investment (12x mark-up), but I’ve admittedly become a complete connected fitness junkie. I’ve been a fairly competitive runner my entire life, yet I’ve never had enough incentive to purchase any at-home workout equipment. It’s worth noting that I braved 5 years of running outside in Chicago Winters. This is how much I hated running on the “dreadmill”. Until the past decade, there were many consumers standing on the sidelines from purchasing at-home fitness equipment. Many times the consumers that did bite the bullet dreaded the terrible experience of doing cardio from a stationary piece of equipment.

With the application of technology that has existed for nearly two decades (thanks Netflix), Peloton reinvented the experience of working out at home. The massive capital tailwinds that have been created from their success has led to the emergence and explosion of new at-home connected fitness devices. These new superior workout experiences have not only taken existing market share from legacy competitors, but they have expanded the Total Addressable Market (TAM) well beyond what the at-home fitness equipment ever was.

I’ve seen more Peloton Copycats than I can count on two hands. Anyone investing in the fitness space has seen countless “The Peloton of…” pitch decks cross their desk. However, few new entrants can truly call themselves Category Definers. Ergatta is in a rare class of its own. A true category definer with a bonafide unfair advantage.

Strap your feet in and let’s flow as I break down a company with one of the most unfair advantages I’ve ever seen.

Enjoy!

Myles

Initial Memo: September 2019

Below is a slightly redacted investment memo that I created while assessing whether or not to invest in Ergatta. This was my first investment memo, so go easy. With nearly 3 years of hindsight, many of the assumptions around the secular and company thesis have not changed, and actually have been validated in a major way. At the time, I was not aware that Covid would accelerate adoption of Connected Fitness, and I did not know that Barry McCarthy would be taking over the helm at Peloton. This is big because his vision for Peloton will undoubtedly change the trajectory for Ergatta, and has strengthened the thesis in a way that I did not anticipate. More to come on that later.

Ergatta – Connected Fitness (New York, NY):

Secular Thesis: The introduction of new disruptive technologies into the fitness realm, mainly led by Peloton, has created the first S Curve shift that the fitness industry has ever seen. As a result of this S Curve shift, the fitness industry is in the early stages of major disruption similar to what I saw with Amazon completely reinventing the way that we shop for consumer goods. Another similar comparison is how Netflix disrupted the movie industry, which ultimately led to the quick demise of Blockbuster and eventually movie theaters.

Given the fitness industry dynamics, I am fairly confident we’ll likely see a slow, multi-decade attrition of brick & mortar boutique fitness studios. Big box gyms, already being hit hard by the boutique fitness boom, will continue to be forced to undergo transformational change to stay relevant. The first of the boutique fitness studios to fade will be the singular-focused studios that offer easily replicable experiences such as cycling or yoga.

Given these new technologies, there have been multiple new connected fitness devices entering the consumer fitness market, making it easier and more effective to work out than it has ever been. Put simply, the economics of owning connected fitness devices compare favorably with gym memberships and boutique fitness classes, and the added convenience of working out from home gives consumers plenty of incentive to spend more money on the consumer fitness category. This has led to a significant expansion of the money consumers are willing to spend on fitness, which has in turn increased TAM within the consumer fitness space.

Furthermore, the continued proliferation of gamification into fitness has also reduced the reliance on individual consumer’s need for heavy intrinsic motivation. This dynamic is being largely disregarded in respect to its impact on TAM. However, I see this having a larger impact on consumer’s willingness to continue to use products for longer periods of time, busting down the historically bear thesis of at-home fitness products being a fad (i.e. Body by Jake, Buns of Steel, 8 Minute Abs, etc). As a result of these new burgeoning technologies, there has been a massive tailwind of capital influx into the connected fitness space, and I don’t see this slowing down any time soon.

Company Thesis: Ergatta is the first ever gamified connected rowing machine. I really loved a few main things about them:

The Team: Their management team was clearly one of the stronger teams I have met. They had previous history working together successfully, are well rounded in terms of skillset, and are led by a top-notch CEO, Tom Aulet.

Gamification: Ergatta more or less invented gamification on the rowing device. There were some other up and coming competitors, but they were all trying to beat Peloton to the rower. Ergatta was paving their own path which I loved, and also was more of a “software first” type of team.

WaterRower Partnership: I really considered this an unfair advantage, as they did not have to worry about manufacturing woes that most other companies entering the space would have to worry about. With this partnership, it allowed their team to cut significant corners, focus on developing the best content, with a fraction of the friction often times caused by hardware development & fulfillment.

Secular Growth Thesis: 2022

In reviewing the secular thesis above, nearly everything has been accurate, but there are still some big unknowns. Given Covid’s impact on the brick & mortar industry, it’s very difficult to say whether or not that downward spiral will continue. However, now that I have seen the industry evolve, I’d like to focus in on where I think we are now in the evolution of connected fitness, and where we are going from here.

The Now

We are now transitioning from the concept of at-home connected fitness being only instructor-led (think Peloton, Mirror, Tonal). While Ergatta defined gamified rowing years ago, one could argue that they really defined the gamified fitness category. Prior to Ergatta, any gamified fitness product consisted of fringe apps or low adoption Virtual Reality (VR) games consumed via Oculus. Now, following in the footsteps of Ergatta, Peloton has recently launched their own gamified cycling experience, Lanebreak. According to many reviews, including PCMag.com, the over 6M Peloton members are starting to learn what we saw coming at Omnidollar nearly 3 years ago: Gamified fitness is fun, challenging and addicting.

As Ergatta paved the way for gamified fitness, Peloton’s embracing the experience is very bullish for the gamified fitness space. Moving forward, I expect adoption to accelerate for Ergatta, new entrants to come to market faster, and more consolidation. While the industry has seen significant secular tailwinds that we have been able to capitalize on at Omnidollar, there’s a massive tidal wave brewing that is setting us for the next leg up over the coming decade.

The Future: The Fitness Creator Economy

Instructor led—>2D gamified experience—>3D gamified experience—>VR & AR have all led us to a monumental moment in the evolution of connected fitness: The birth of the Fitness Creator Economy. Below I’ll highlight two key elements merging at the same time that will continue to expand the TAM and accelerate adoption of connected fitness.

The “Apple of Fitness”

Barry McCarthy’s recent appointment as CEO of Peloton has changed the ball game in Connected Fitness. Oftentimes coined “The Apple of Fitness”, Peloton lived up to that title in respect to creating superior hardware & software products in a vertically integrated ecosystem. However, former CEO John Foley seemed to be more dedicated to a closed ecosystem vs the Apple model. For example, when you receive a Peloton bike or tread today, the only app you are able to consume is Peloton. Given that Peloton is operating on an Android tablet, they in theory could unlock this to allow for any app to be consumed on their hardware. Foley seemed stubborn in his vision to be a closed platform, but with a new CEO comes a new vision. In a February 2022 New York Times interview with McCarthy, he said:

“Today, it’s a closed platform — but it could be an open platform and part of the creator economy. What other apps would you put on it? Could it be running an app store?” -Barry McCarthy

This changes everything. He backed this comment up in a recent email to Peloton staff outlining his vision for the company and connected fitness. Out of the 4 main points, Software and Platform were highlighted. Given that Peloton is the de facto leader in the connected fitness space, this signals that the future of the industry is in software experiences well beyond streaming instructor-led classes.

The Metaverse

In addition to Peloton potentially moving to an open platform, the Metaverse is now in its infant stages and will surely have massive implications on the connected fitness space over the next 10-20 years. Meta (formerly Facebook) is already placing bets here as they acquired Virtual Reality (VR) fitness tool, Supernatural for $400M. This may seem like a steep price tag, but it’s estimated that VR and AR have the potential to add $1.5T to the global economy by 2030 (PWC: Seeing is Believing). Put simply, there is a lot of money being invested and a lot of activity at the intersection of the Metaverse and fitness. Below are some recent relevant examples to highlight the momentum:

This year at SXSW, an entire session on VR Fitness was hosted in the Metaverse.

There is a Virtual Reality Institute of Health and Exercise (what??).

The Metaverse already has fitness studios.

Hiro Capital launches second $340M Metaverse Fund, citing Gamified Fitness as a core focus.

Because the Metaverse is appearing to be a truly decentralized virtual world, the opportunities are endless, and it is already showing its potential to be a massive creator economy.

What this means is that developers globally will now be able to produce new connected fitness experiences to be consumed through Peloton’s platform and the Metaverse. So what does this mean for Ergatta?

It appears that we are about to enter a fitness creator economy gold rush, similar to what we saw when Apple launched its first Apple App Store. Given that Ergatta defined the gamified fitness experience years ago, and already allow for user generated content, they are in the pole position to lead the new fitness creator economy.

The Opportunity

It would have been really easy and “sexy” to title this memo, “The Peloton of Rowing”. It also would have been really easy to look at this investment and pass because, “Peloton is eventually going to launch a rower”. Admittedly, I did have that concern and Peloton will most certainly launch their first rower in the not so distant future (rumored for May 2022). However, when I looked at this investment opportunity, I saw a talented team creating a new category in a massive, misunderstood market: Gamified Connected Fitness.

Fitness Gamification

To make this super simple, fitness gamification is nothing more than Fun meets Fitness:

The value proposition is also quite simple:

Convenience: Super easy and affordable to consume.

Community: Feeling of belonging well beyond my local gym.

Content: Games make working out fun.

Convenience

Let’s assume someone makes $100K salary per year. That breaks down to $48.07 per hour. When I used to go to the gym, it would take me about one hour of preparing & traveling to/from the gym. If I work out 5 days a week, that comes out to be about $961 per month of time wasted. To add to this, I either had to work out in the early morning or evening which forced me to miss the opportunity to spend time with my daughter. Finally, let’s factor in that I am already paying $79 per month for my gym membership. All in with opportunity cost and raw costs, I am actually paying $1,040 per month.

The cost of an Ergatta is $2,199 up front and then $29.99 monthly. Based on the above metrics, my breakeven on the hardware would be about two months in. From that point on, I am deeply in the green by about $1,000 per month.

Ultimately, time on this Earth is our most finite and limited asset. Give someone back their time at a reasonable out of pocket expense, and you’ve got yourself a business.

Community

Every successful fitness company, regardless of brick & mortar or digital, has created a keen sense of community. Feeling as if you belong caters to an important human survival instinct, especially when your body is in a stressful state (working out). The need for community within a fitness environment keeps consumers engaged, and much more inclined to continue to participate, ultimately increasing retention. Unlike physical boutique studios & gyms where your community is hyperlocal, Ergatta’s community spans as far as an internet connection is available.

Content

“The core thing that we are doing that’s interesting and different is content creation. That’s the magic that we bring. That’s a product that is ultimately not specific to rowing.” -Ergatta CEO, Tom Aulet

And now on to the secret sauce: Content. Peloton created their massive brand from these three components. As I watched them scale, I knew that the instructors were a key ingredient, but it wasn’t until I assessed the investment in Ergatta that I began to realize that this was where the real magic happened. Ergatta opened my eyes to the fact that there was a large group of individuals like myself that never enjoyed the instructor-led class experience (Peloton’s content). I’ve always used my workouts as a time to shut off the World, put some music on, and just zone out. This fitness ideology is not conducive to instructor-led classes. By creating an immersive, fun, gamified fitness experience, Ergatta has proven and validated that there is demand for great fitness content beyond instructor-led classes.

It’s so easy to look at the connected fitness industry and believe that superior hardware is a key differentiator. Sure, the quality of hardware is very important. However, content is king. Superior, addictive content makes a consumer’s mind hardware-agnostic. If you create a beautiful workout experience that makes something that sucks even 10% better, your TAM expands as hardware becomes less meaningful. Take the quote below:

“Over 40% of our customers that we polled, had never been on a rowing machine before.” -Tom Aulet

This tells me that the content is the key differentiator as people who never rowed, or if you’re like me and hated rowing, are now active rowing community members.

And because Ergatta has been unfairly focused on building the best possible game-based fitness content since the very beginning, they are years ahead of competition in both their content library & experience. Furthermore, the beauty of their content is that it is hardware agnostic, significantly expanding the TAM as we enter into the fitness creator economy.

The Team

Over the years, I have developed a great relationship with Tom and have a ton of respect for him, Prasanna and Al. I was super impressed from the first time that I met with them. I loved that they had such a rich history in working together at MediaMath. But most importantly, it was clear to me that Tom was a product first executive and he was staunch on Ergatta being a product-led organization. This means intently listening to your customers and delivering product around the core persona that you serve:

“A customer-centric approach to product development, which is iterative and aligns on certain core principles and strategic pillars of the product. But designs, develops and rolls out and improves on products in an iterative, customer-focused way. The people in charge are experts in that.” -Tom Aulet

As a consumer of Ergatta, my firsthand experience is that the software experience is amazing. This is a testament to the team and their unrelenting focus on product and customer.

The Product

“We want to deliver the leading game-based fitness experience in the World. We’ll always bundle that with premium hardware, but it could mean a number of different things.” -Tom Aulet

The Ergatta is a beautiful piece of equipment both inside and out. The wood finish combined with the swishing sound of water as you row makes you feel like you’re working out on a piece of furniture that belongs in a Cape Cod vacation home. Similar to Peloton, the attached Android tablet is in a closed environment and your only choice is to consume Ergatta’s app.

When you first use the hardware, there’s a 5 minute calibration row that personalizes the rowing experience specifically to your physical capabilities. Based on your output, Ergatta will create 4 different effort levels for you which matriculates throughout the different workout experiences. This is an important part of the stickiness of the product. If a game is too difficult or too easy, the consumer easily loses interest. But if the competition is just right, that’s a beautiful ingredient to keep someone highly engaged, while also leading to great physical results from their workouts. This calibration continues to improve as you do.

There are 4 main ways to consume their content:

Push Programs: Longer-term, goal-based training programs that culminate with a final challenge.

Interval Workouts: HIIT and endurance workouts with personalized targets and real-time feedback.

Open & Scenic Rows: Self-led, more relaxed rows at various world destinations with distance of time goals.

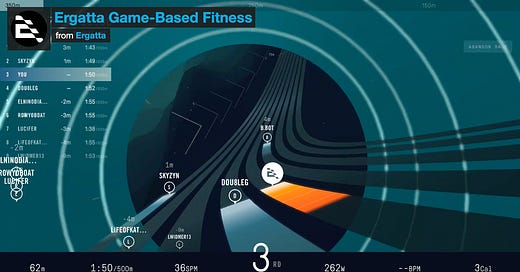

Races: Head to head competitions with the rest of the Ergatta community. These races are both 2D and 3D.

Since we invested, Ergatta has made tremendous improvements to the app, including the auto calibrate feature, meteor intervals and 3D races. This is in addition to a ton of new features, integrations and endless new content. Dollar for dollar, Ergatta has significantly outpaced their competition in delivering new product & content.

The last piece of that is key, and is the result of what I saw as a massive unfair advantage.

The Unfair(est) Advantage

"How are we going to win? Focus. Every morning for the past three years, we’ve got up and thought about a very specific consumer and a very specific set of tools to entertain, motivate and drive habit-forming behavior for fitness. That’s what we do every single day. That’s the core focus of the business. This is existential. This is the core vision of the business.”

This was a quote from CEO Tom Aulet when interviewed on Episode 100 of Fitt Insider.

At Omnidollar, we seek to support and invest in innovative disruptors that are creating unstoppable secular shifts in consumer behavior. These unstoppable secular shifts in consumer behavior are the foundation of our investments. Over the past year, I decomposed our wins and losses to formulate the key components of a great potential investment. Given that Ergatta has been our most successful investment to date, with a mark-up of about 12x from our pre-seed/seed round investments, I honed in on this investment to understand what made it so special.

In the end, it had all of the major components that I’ve always looked for in investments over the years:

Solid Secular Growth Story

Great Opportunity Within the Thesis

Proficient Product Heavy Team

But as I assessed this particular investment, I noticed that there was something different that undoubtedly has been their secret sauce: A Significant Unfair Advantage.

Ergatta had a partnership with WaterRower that set them up to scale in a few key ways:

Hardware: Instead of worrying about sourcing parts, manufacturing, fulfillment and hardware warranties, Ergatta was able to reallocate resources that would have been spent on developing hardware to nearly 100% focused on building amazing game-based fitness content.

Installed Base: Ergatta had something that WaterRower wanted (technology), and WaterRower had something that Ergatta wanted (hardware & a massive installed base). Because of the latter, Ergatta was able to sell much easier than if they were tasked with going out and acquiring new customers from scratch.

Given that Ergatta was founded in a dynamic where they are partnered on hardware and not building it, the entire structure of the company from foundation up is built to scale in this same manner. In a creator economy, Ergatta is set up perfectly to partner with other hardware companies to proliferate their higher margin subscription business in not only rowing, but any fitness vertical. This is what makes Ergatta the (un)fairest of them all.

The Business

Over the years, I’ve become very attracted to SaaS+ businesses where software is combined with hardware. Not only does the hardware many times make the high margin subscription more sticky, when done right, the cost of acquisition (CAC) is covered by the sale of the hardware. This leads to Ergatta’s unit economics (LTV/CAC ratio) actually being too high, which is rarely seen. As the subscription installed base continues to grow, they have much more capital to allocate toward key areas of the business such as R&D. All in all, the business is extremely capital efficient and scales fairly seamlessly.

Economics

Ergatta’s pricing is very straightforward:

Rower: $2,199

WaterRower Upgrade Package: $549

Subscription: $29.99 monthly

As mentioned above, the unit economics of the connected fitness space in general are extraordinary and was a big part of my bullishness when considering this investment. This can be highlighted from Peloton’s November 2019 Company Overview which would be very similar to the economics of Ergatta:

Traction:

According to a Bloomberg article from April 2021, Ergatta boasted over 10K users. This insinuates that they grew their user base from 0 users to 10K in about a year! If you apply that same growth and assume that majority of their users will purchase during the retail heavy holiday season, they’ve likely eclipsed well over 20K users. This would translate to annual recurring revenue (ARR) of over $7M, and total annual revenue of over $40M.

Summary

Ergatta has experienced an incredible amount of success out of the gates and I don’t see this momentum stopping any time soon. Coming out of a global pandemic that served as a tailwind to the connected fitness industry has led many to wonder if the demand for products like Ergatta was pulled forward. It undoubtedly did pull some demand forward, but it also forced many consumers to explore new ways to work out, bringing in new participants that never had prior intentions to own at-home workout equipment. The fitness landscape has permanently changed, and demand has accelerated for at-home connected fitness solutions.

The next leg up will be the fitness creator economy, and if there was one horse that I would pick for that race, it would be the collective of Tom, Al, Prasanna and the Ergatta Team. The next connected fitness unicorn.